Annuity with inflation formula

According to the US. Ad Learn More about How Annuities Work from Fidelity.

What Is An Annuity Table And How Do You Use One

11 Little-Know Tips You Must Know Before Buying.

. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. These annuities tend to provide a lower payout to investors than other types of annuities on the market. Theres actually a much simpler way to derive this formula.

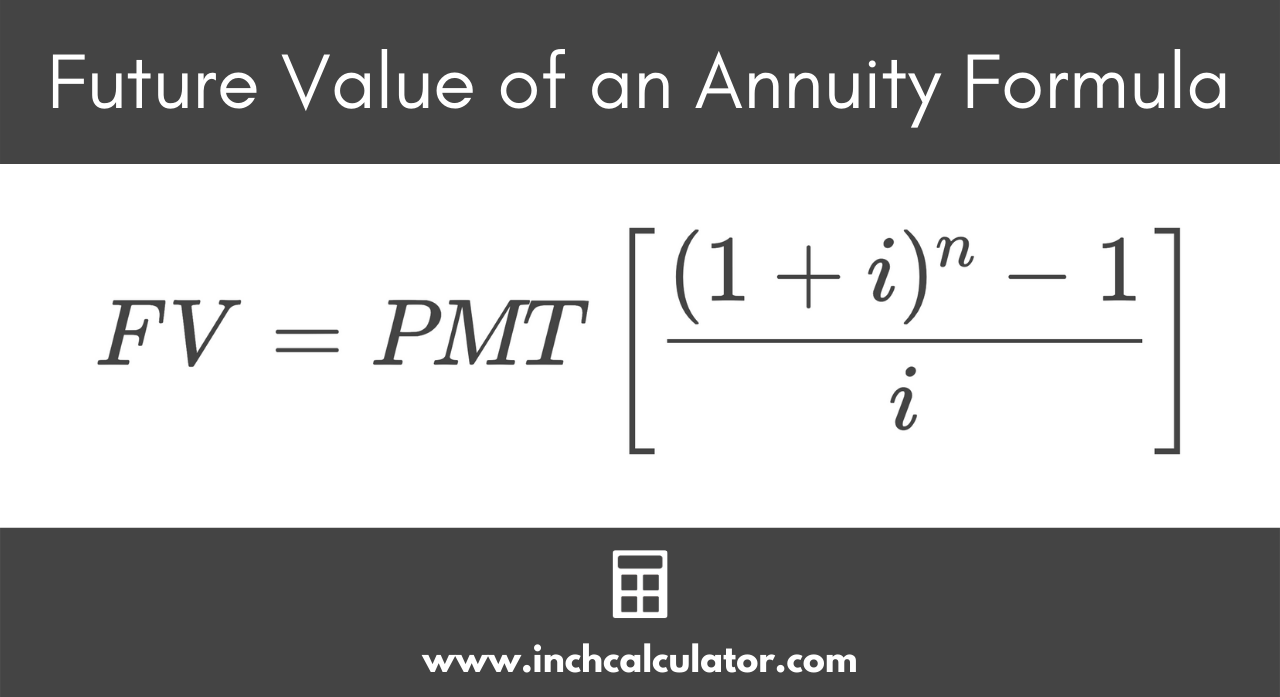

Future Value of an Annuity C 1in - 1i where C is the regular payment i is the annual interest rate or discount rate in. Heres the deferred growing annuity formula Deferred Annuity P Ordinary 1 1 r-n 1 rt r Here P ordinary is used for Ordinary annuity payment r is used for an effective rate of. An inflation-protected annuity IPA is a type of annuity product.

Ad A Calculator To Help You Decide How A Fixed Annuity Might Fit Into Your Retirement Plan. If x is our initial payout then its present value is obviously just. Calculation using Formula.

5000 at 6 for 3 years is higher. A Fixed Annuity May Provide A Very Secure Tax-Deferred Investment. Dont Buy An Annuity Until You Review Our Top Picks For 2022.

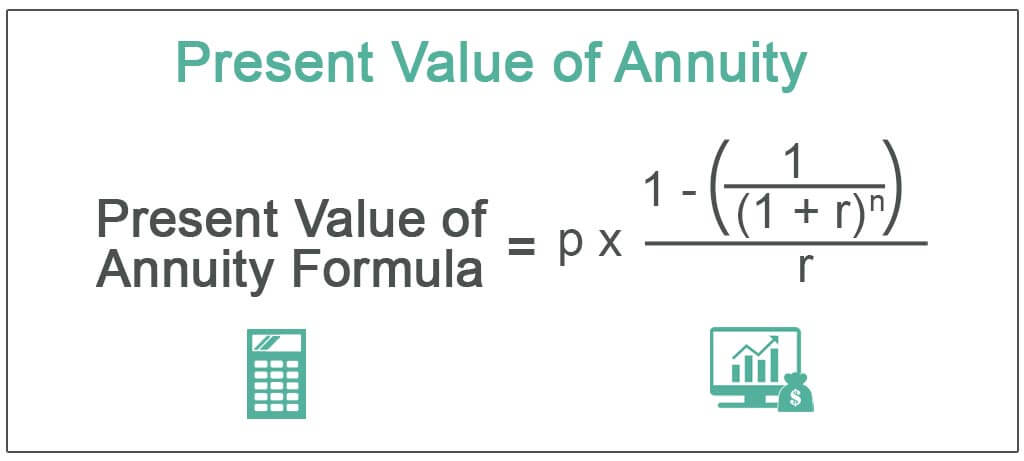

The future value of an annuity due for Rs. Step 3 Raise your first answer to the power of. Begin aligned text PV_ text OrdinaryAnnuity text C times left frac 1 - 1 i -n i right end aligned PVOrdinary Annuity C i1 1 in.

For example if you have a 1 million nest egg you would withdraw 40000 the first year of retirement. Let I104 be the inflation rate and Y110 be the investment yield. Learn More On AARP.

Fixed index annuities and variable annuities with lifetime income riders are two types of annuities that offer protection against inflation. If inflation that year is 2 in the second year of retirement you would. Which Annuity Hedges Against Inflation.

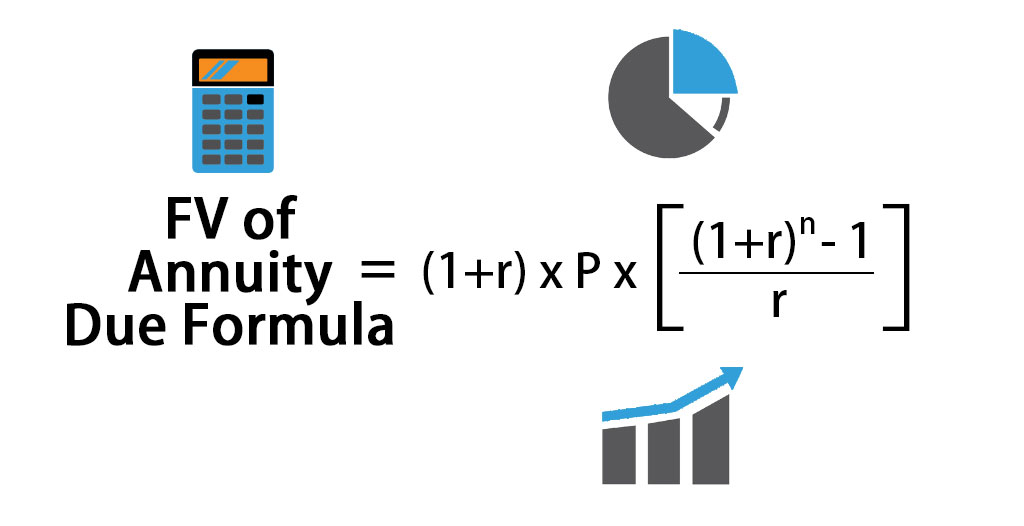

FV 3 annuity due 5000 16 3 -16 x 16 1687308. For example if the annuity issues payments for five years multiply 5 by -1 get -5. For example if the average annual inflation rate is 3 percent over the next 20 years it will cost you 181 to.

By using the geometric series formula the present value of a growing annuity will be shown as This formula can be simplified by multiplying it by 1r 1r which is to multiply it by 1. In words at the start of next year the investment is P 1I and the return less the increased payout of p 1I leaves an investment of P 1I2 for the following year. Step 2 Multiply the number of years in the annuity by -1.

The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where. Ad Learn More about How Annuities Work from Fidelity. Even a low rate of inflation can significantly erode purchasing power in the long run.

An annuity investment that. The primary risk of most annuity payouts therefore is inflation. If your annuity pays a fixed 3000 per month for life and inflation increases 10 the buying power of your.

Securities and Exchange Commission the real rate is the true economic benefit offered by an investment after taking into account taxes and inflation. The calculation of an annuity follows a formula.

11 3 Present Value Of Annuities Mathematics Libretexts

Annuity Present Value Pv Formula And Calculator Excel Template

Present Value Of An Annuity How To Calculate Examples

Present Value Of Annuity Due Formula Calculator With Excel Template

Present Value Of An Annuity How To Calculate Examples

Future Value Of An Annuity Calculator Inch Calculator

Growing Annuity Formula With Calculator Nerd Counter

Future Value Of An Annuity Formula Example And Excel Template

Present Value Of An Annuity Definition Interpretation

Annuity Due Formula Example With Excel Template

Annuity Formula Annuity Formula Annuity Economics Lessons

Future Value Of Annuity Due Formula Calculator Excel Template

Present Value Of A Growing Annuity Formula With Calculator

Present Value Of A Growing Annuity Formula With Calculator

Growing Annuity Formula With Calculator Nerd Counter

Ordinary Annuity Calculator Future Value Nerd Counter

Ordinary Annuity Calculator Future Value Nerd Counter